A Year to Remember

It was 75 years in the making, and celebrating our Diamond Anniversary all year long with members, staff, and our community was so much fun.

We enjoyed so many special moments and events that we compiled many into one fun video below.

Whether you joined our first-ever movie night, member-day soccer match or any of our branch events, you helped us celebrate 75 years of being part of Ventura County.

$750,000 given to our communities

Giving back to the community is a core part of our mission. We celebrated 75 years by giving back $750,000 to local organizations you know and trust. This money is already at work in so many ways, and we’re proud to have been able to significantly support these groups as part of our celebration:

December 2024 FoodShare of Ventura County

February 2025 Turning Point Foundation

April 2025 Ventura County Community Development Corporation

May 2025 Ventura County Family Justice Center Foundation

July 2025 Reel Guppy Outdoors

August 2025 El Concilio Family Services

August 2025 Community Action of Ventura County

October 2025 Moorpark College Foundation

November 2025 Healthcare Foundation VC

December 2025 Museum of Ventura County

We are grateful to you, our member owners, who have made us the largest credit union headquartered in Ventura County. You are the heart of who we are and we celebrate you.

Rewards on Everyday Purchases

Simply Rewards Checking is here to make your everyday purchases even more rewarding with all the features of our Simply Classic Checking.

- Paying for groceries? Earn rewards!

- Paying the vet? Earn rewards!

- Buying snacks for the soccer team? Earn rewards!

With debit card rewards, you earn points on qualifying purchases (1 point per $3 spent)* that you can redeem for cash back, travel, merchandise and more. Simply Rewards Checking has everything you want:

- 30,000+ surcharge-free ATMs

- Mobile Wallet — Apple Pay, Samsung Pay and Google Play

- Tap & Go Contactless Payments

- Early Payday Direct Deposit

- Credit score monitoring and much more

Bundle Up Rewards

Earn even more when you combine Simply Rewards Checking with your VCCU Platinum Rewards Credit Card.

Learn more and open your account here.

*All accounts subject to approval. Restrictions may apply. See VCCU Rewards for full details.

Sharing Made Rewarding

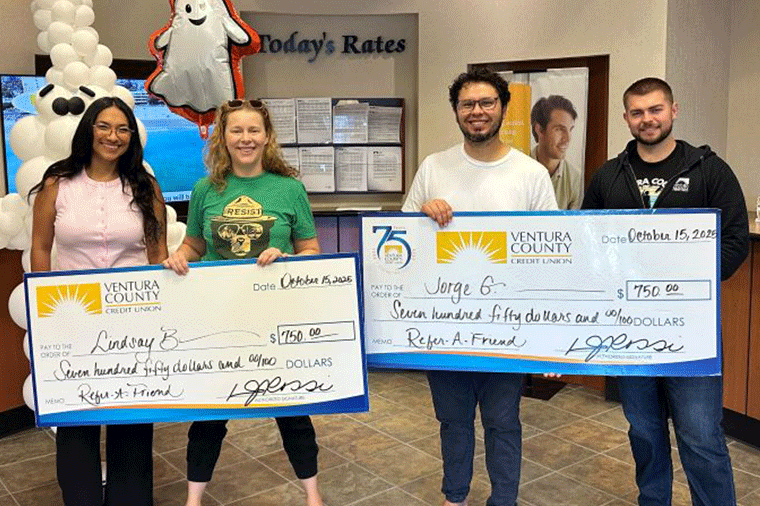

We made our 75th anniversary celebration a Win-Win for you and your referrals. Throughout 2025, every time you referred family, friends, co-workers, or neighbors, not only did you share our great financial services, you both were entered to win $750 each quarter.

Congratulations to all of our winners. And thank you to everyone who referred us — we’re grateful for the confidence you place in us.

Congratulations to our winners!

Q1 Winners Elva and Lee

|

Q2 Winners Margarita and Christopher

|

|

Q3 Winners Lindsay and Jorge

|

Q4 Winners Martha and David

|

|

Q4 Winners Berenice and Fernando

|

New Year, New Scams

It’s a new year and scammers have been using new ways to steal money and more from you. We encourage you to read more and share this information with the people you care about — as they say, sharing is caring.

Younger consumers targeted as money mules

A “money mule” is someone who unwittingly helps a criminal move money obtained illegally. Criminals often target students or dating websites to recruit participants.

The schemes vary, but often involve a student opening a legitimate bank account in their own name, then receive funds from someone they’ve never met. Victims are promised a portion of the money transferred with the rest to be wired or converted into crypto. Even if they don’t understand their role, being a money mule is a federal crime and can result in jail time and fines.

Tips to spot money mule schemes:

- Never let someone you meet online “use” your bank account

- Never release financial information unless you clearly understand why

- Always be skeptical and avoid fast money offers

Squishing “Quishing”

QR codes are everywhere and help us quickly get to a website, app or more. But, remember that a QR code is unfortunately like a sealed envelope — you can’t see what is inside until you open it.

That’s why its important to understand Quishing, a scam that uses malicious QR codes to take you to fake websites that steal your information or install malware. Because the URL is concealed until you load it, scammers can bypass traditional malware filters.

QR codes in a store or sign might look legit, but can easily be altered or replaced with fake ones. To protect yourself, never scan a QR code that’s on a sticker or part of an unsolicited e-mail. If you can’t resist scanning, check the link preview feature on your device to confirm the site or URL. If in doubt at all, don’t scan it. Learn more by searching for "quishing" at our Security Resource Center.

New Year checklist to protect yourself

Make sure you’ve taken these simple steps to protect your accounts:

- Set up real time alerts with Digital Banking to customize notifications when there is activity on your account such as a deposit, purchase without your card being present, balance updates and more. We make it super-easy to monitor your money in real-time.

- Use our free My Credit Score service to monitor your credit score and get alerts in case a scammer tries to open credit in your name.

- Half of Americans use a pet’s name as their password most everywhere, and that’s risky. We recommend using more complex passwords, differing passwords, and also changing them periodically. Using the same password at multiple places exposes you when any one site is compromised.

Season of Giving

CAN-tree Drive

We were honored to be a presenting sponsor for Food Share of Ventura County’s 14th Annual CAN-tree event. In addition to raising funds, we sponsored and built the $10,000 15-foot giant CAN-tree along with five additional CAN-trees.

Food Share of Ventura County is experiencing an unprecedented demand for its services and we encourage you to also donate. For every $1 you donate, Food Share is able to turn it into 3 meals for those in most in need.

Ribbons of Life

If you visited any of our branches in October, you saw a sea of pink ribbons, each one sponsored in the name of a loved one, friend, colleague or neighbor who has faced breast cancer.

Our members and staff raised $1,927.32 to support Ribbons of Life, a local non-profit providing breast cancer education, advocacy, emotional and social support. We were honored to attend their monthly support meetup to present the donation in December.

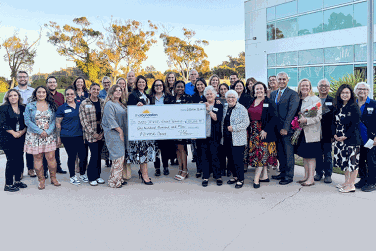

2025 Grant Awardees

Through The Foundation of VCCU, we’re proud to champion our local community with financial assistance and education! A huge congratulations to these remarkable recipients for their inspiring work, uplifting underserved communities, driving beautification and environmental initiatives, and promoting health and well-being. Your impact truly makes a difference!

Foundation $10,000

4 Kids 2 Kids $10,000

Assistance League Conejo Valley $5,000

Social Justice Fund for Ventura County $10,000

Girl Scouts of California's Central Coast $10,000

Teen Challenge of Southern California and Ventura $10,000

Canine Adoption and Rescue League $2,500

Creative Steps $2,500

Livingston Memorial Visiting Nurse Association $5,000

Big Brothers Big Sisters of Ventura County $5,000

Interface Children & Family Services $5,000

Senior Veterans Home Solutions $7,500

Samaritan Center - Simi Valley $7,500

If you are interested in learning more about our foundation, want to make a donation or apply for grant, visit The Foundation of VCCU on our website.