Helping you improve your finances and get the most out of your money.

Learn More: Learn More

Ventura County Credit Union is with you every step of the way.

Helping you live your best life

Ventura County Credit Union is with you every step of the way.

-

- 0

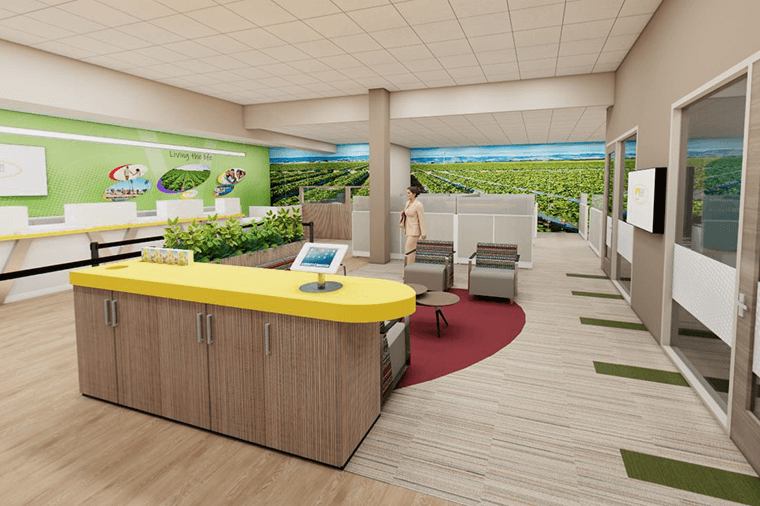

- Educational Workshops

-

- 0

- Workshop Attendees

-

- $0

- Community Giveback

-

- 0

- Community Events